Products

JLG Method

Prarambh Finance follows the JLG Model. A JLG is an informal group of 8 to 10 members who have come together to for the purpose of availing the loan from MFI on individual basis. The Group members are engaged in similar type of economic activity, dwelling in the same vicinity and agree to take the liability for repayment of loans of each other in case of default by any individual member of that group.

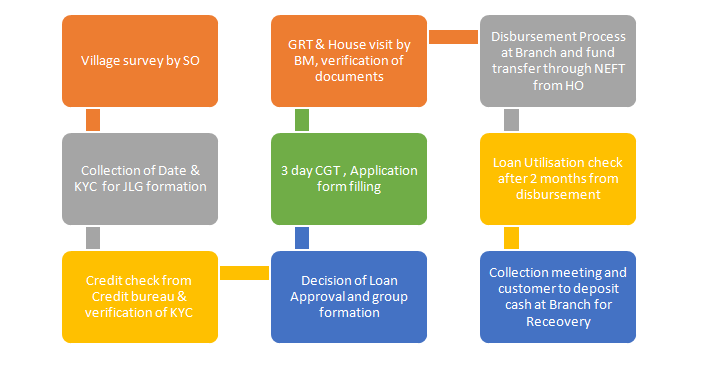

The process followed by Prarambh Finance can be summarised as under.

Surveying the area and the target borrowers is the first step. Prarambh Finance plans to operate in the semi urban and rural area of Chhattisgarh targeting the economically active women in the age group of 18 to 58.

Once the area and target borrowers are identified, the process of forming small groups of 5 to 15 is initiated.

This group formation further involves these three broad steps.

a) Collection of KYC/Credit Bureau check: The sales officer of the MFI collects the KYC and other details like income, expenses, excising borrowings etc of the potential member of the group. After filtering the same and those who pass the preliminary check, these details are then send to Head Office for credit bureau check. Thereafter the credit back office team at HO approves/disapprove the credit and send the details of successful members back to branches.

b) Compulsory Group Training (CGT): The sales officer of the MFI conducts the CGT of those selected prospective borrowers, whose credit have been approved by credit team at HO. CGT is conducted in the residence of one of the propsctive member of the group for 1-2 hours for 3 days. The agenda of the training is to educate the prospective borrowers about the MFI, the JLG concept, terms and conditions of loan, the insurance coverage, processing fees involved, financial literacy etc.

c) Group Recognition Test (GRT) & KYC: Once the CGT is done by Sales Officer, GRT is done by the branch manager. This is done to ensure that all the terms and conditions are properly explained to the borrowers and understood by them and also to verify the authenticity of the borrowers. The GRT also ensures that the borrowers are eligible for the loan. The Branch Manager then does house visit of each member and rechecks the KYC with Original.

After the GRT is done and passed by BM, disbursement is done directly in the bank account of the borrower thru NEFT.During the disbursement they are given an individual loan card with details of loan and EMI schedule in detail. A group register is also maintained. The loan card acts as a bank pass book. As per the terms of loan, on every due date all the members are suppose to be present at the centre and deposit their EMI to the Sales officer. The sales officer acknowledges the receipt on the loan card.

As the name suggests, in the event of any member not able to repay the EMI of any month or refuses to repay the loan, all the remaining members are suppose to make for the shortfall. This is the mainstay of JLG model. It ensures that all the members take care in knowing each other before forming the group. However in case of default, the company does not use any force/coercive method to recover the loan amount.

All the data related to loan disbursed and delinquencies are to be periodically forwarded to all the Credit Information Companies for their record.

Loan Amount – 10,000 – 70,000 Rupees

Loan Tenure – 1-2 Years

Loan Purpose – For Business and Income Generation

Key Terms & Condition –

- Interest Rate: 25% Max 28% Average 26.5% Per Annum (Reducing Basis) wef from 01-04-2022

- Processing Fees: 2% of loan amount plus GST

- Insurance Charges: 8.35 per thousand per year

- No prepayment Penalty

- No additional Charges for Late Payment